Capital Asset Pricing Model for IBM Stocks

Analysis of IBM’s 1994-2015 stock market performance using Capital Asset Pricing Model (CAPM).

Step 1: Imported the data into RStudio environment

The data contains:

- Dates (Jan 1994 - Dec 2015)

- IBM’s daily return

- Market’s daily return

- Daily risk-free rate

Step 2: Computed yearly excess market and IBM stock returns

lg <- length(ibmRET)

IBMEXRET_Annualized <- rep(NA,lg)

marketEXRET_Annualized <- rep(NA,lg)

for (i in 252:lg){

IBMEXRET_Annualized[i] <- (prod(IBMEXRET[(i-252+1):(i)]/100+1)-1)*100 # Daily excess IBM returns

marketEXRET_Annualized[i] <- (prod(marketEXRET[(i-252+1):(i)]/100+1)-1)*100 # Daily excess Market Returns

}

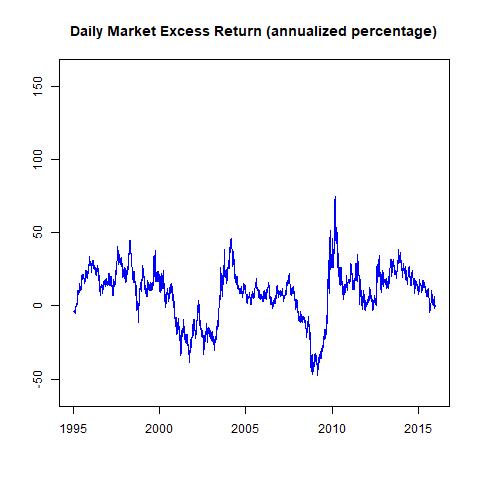

Time-series plot of market’s annual excess return:

Step 3: Found the global maximum

On 3rd September 2010, the market was at the global maximum (75.06%).

Step 4: Computed 5-yearly excess market and IBM stock returns

IBMEXRET_5Year <- rep(NA,lg)

marketEXRET_5Year <- rep(NA,lg)

for(i in (252*5):lg){

IBMEXRET_5Year[i] <- (prod(IBMEXRET[(i-252*5+1):(i)]/100+1)^(1/5)-1)*100 # Five-year IBM excess returns

marketEXRET_5Year[i] <- (prod(marketEXRET[(i-252*5+1):(i)]/100+1)^(1/5)-1)*100 # Five-year Market excess returns

}

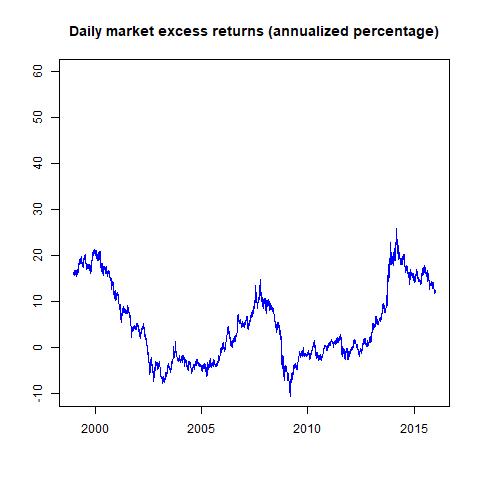

Time-series plot of market’s 5-yearly excess return:

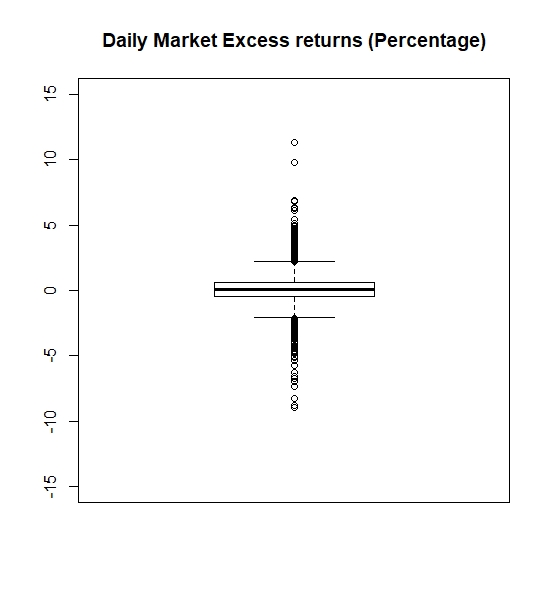

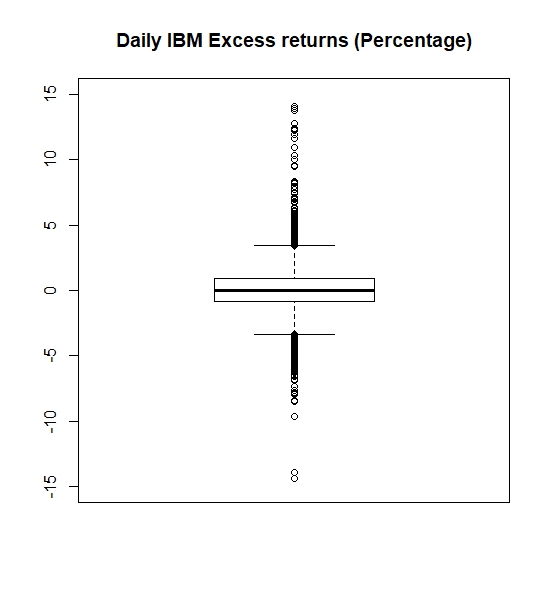

Step 5: Visualize the spread of the daily returns

- Boxplot of excess market returns:

- Boxplot of excess IBM’s stock returns:

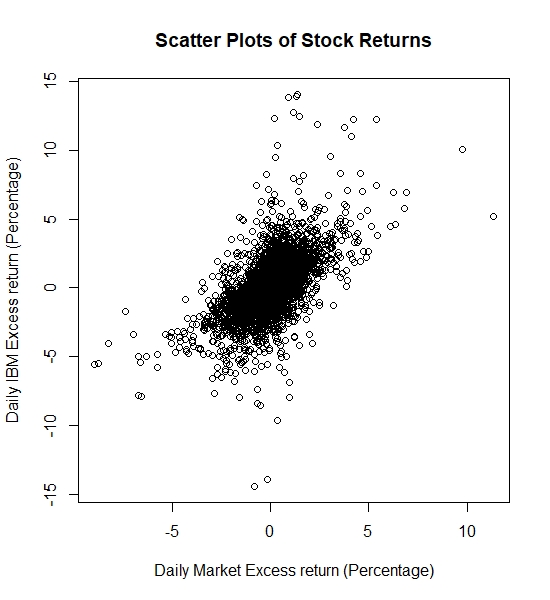

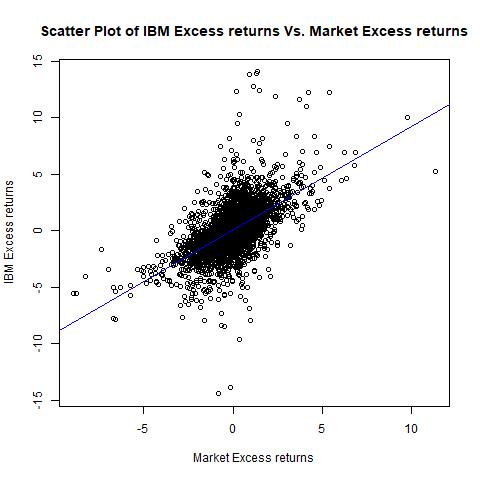

- Scatter-plot of daily IBM vs. market excess returns:

Step 6: Check the various moments of IBM’s and market excess returns:

| Metric | IBM’s daily stock return | Market’s daily stock return |

|---|---|---|

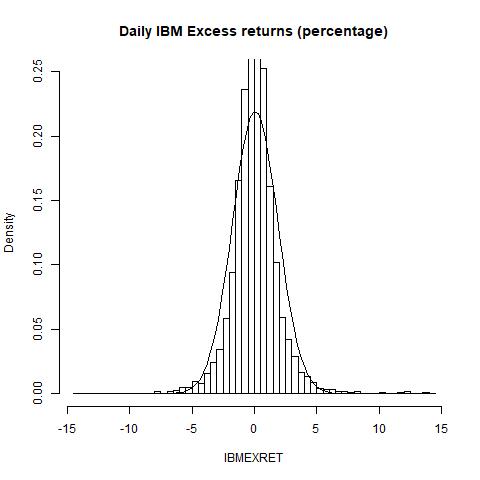

| Mean | 17.38198% | 7.892513% |

| Standard deviation | 28.8362% | 18.83606% |

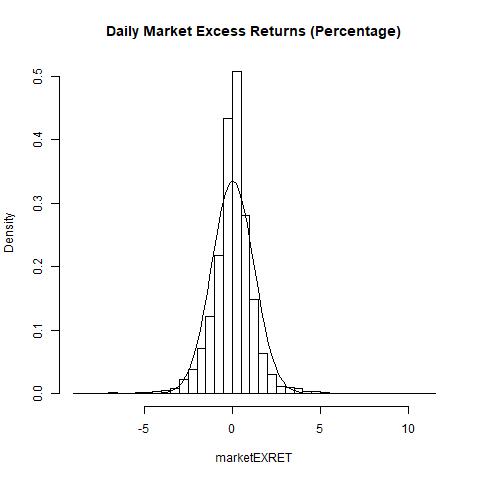

| Skewness | 0.580013 | -0.1168607 |

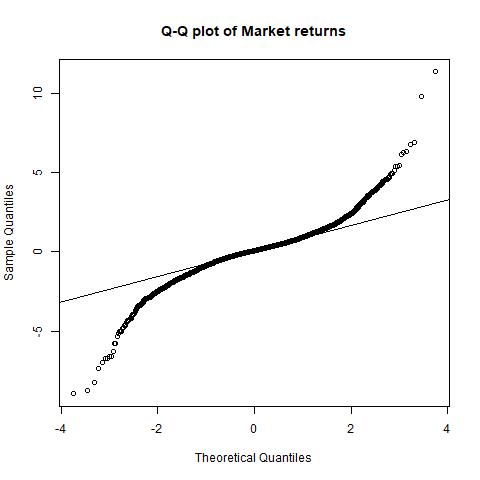

| Kurtosis | 8.060213 | 7.639527 |

| Minimum | -14.41947% | -8.95% |

| Maximum | 14.05134% | 11.35% |

| Sharpe ratio | 0.6028 | 0.4190 |

| Value at Risk | -2.6330% | -1.8305% |

| Expected Shortfall | -3.9803 | -2.8095 |

| Correlation | 0.5956 | NA |

Histogram of market’s excess returns:

Histogram of IBM’s excess returns:

QQ-plot for market’s excess returns:

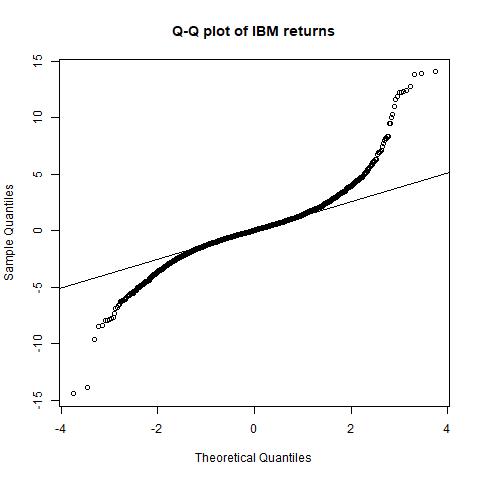

QQ-plot for IBM’s excess returns:

Step 7: Hypothesis testing

- The Jarque-Bera Test:

- For IBM: X-squared = 15322, degrees of freedom = 2, p-value < 2.2e-16

- For market: X-squared = 13498, degrees of freedom = 2, p-value < 2.2e-16

- The Lilliefors Test:

- For IBM: D = 0.081205, p-value < 2.2e-16

- For market: D = 0.084228, p-value < 2.2e-16

Step 8: Linear model estimation

We try to explain the behavior of IBM’s returns through market’s returns.

Results:

- Residuals:

| Min | 1Q | Median | 3Q | Max |

|---|---|---|---|---|

| -13.8015 | -0.6594 | -0.0582 | 0.5996 | 12.9184 |

- Coefficients:

| Coefficient | Estimate | Std. Error | t value | Pr > t |

|---|---|---|---|---|

| (Intercept) | 0.04042 | 0.01961 | 2.061 | 0.0394 |

| marketEXRET | 0.91177 | 0.01653 | 55.175 | <2e-16 |

Residual standard error: 1.459 on 5538 degrees of freedom

Multiple R-squared: 0.3547, Adjusted R-squared: 0.3546

F-statistic: 3044 on 1 and 5538 DF, p-value: < 2.2e-16

Plot of OLS line:

Alternate hypothesis: Is the risk adjusted returns zero? Result: Cannot reject null hypothesis, so risk-adjusted returns are not zero!

Note:

-

Sharpe ratio:

-

Value at Risk (VaR):

-

Expected Shortfall:

, where

is the confidence level